Our Solutions

Asset Management

Asset Manager at LS Advisors

Our Management Philosophy in Europe and Around the World

Our DNA

LS Advisors specializes in discretionary management across Southern Europe, Africa and Asia, with a focus on risk management, medium-term performance and asset diversification beyond traditional assets. We can natively integrate various asset classes into your portfolio, such as Private Equity, Private Debt, Structured Products, Real Estate, Infrastructure, Commodities, Hedge Funds, Real Assets (e.g. Forests, Art, Airplanes or Helicopters), and even Cryptocurrencies, along with traditional asset classes like equities or bonds.

Since 2008, government and central bank subsidies have continued to benefit the most liquid assets (notably OAT, bonds and equities). However, since 2020, we have observed a significant decline in the yields of these liquid classes, coupled with an increased correlation among these assets, leading to a substantial diversification challenge for traditional diversified asset managers.

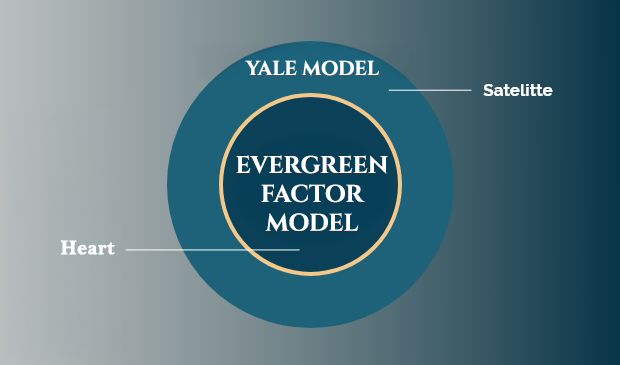

Since 2006, we have held the conviction that performance must be achieved within a framework of controlled and minimal risk, prioritizing diversification into uncorrelated assets, irrespective of liquidity. This belief has lead us to develop a unique core-satellite model, allowing us to manage your assets with risk parity and without financial leverage.

The Result: A Risk Parity Model Without Leverage

Rather than allocating large portions of the portfolio based on expected returns, we prefer to analyze and reason according to the risks undertaken. The core of the portfolio enables us to detect major trends and stay aligned with the economic environment, while the satellite strategy allows us to diversify alpha generation sources and reduce the portfolio’s average volatility.

Our Asset Management Models

Core Investment: Evergreen Funds

The core portfolio of LS Advisors is an "Evergreen" factor model inspired by Ray Dalio's and Tony Robbins' All Weather frameworks, who were among the first to highlight an investment strategy that remains resilient throughout all phases of the investment cycle.

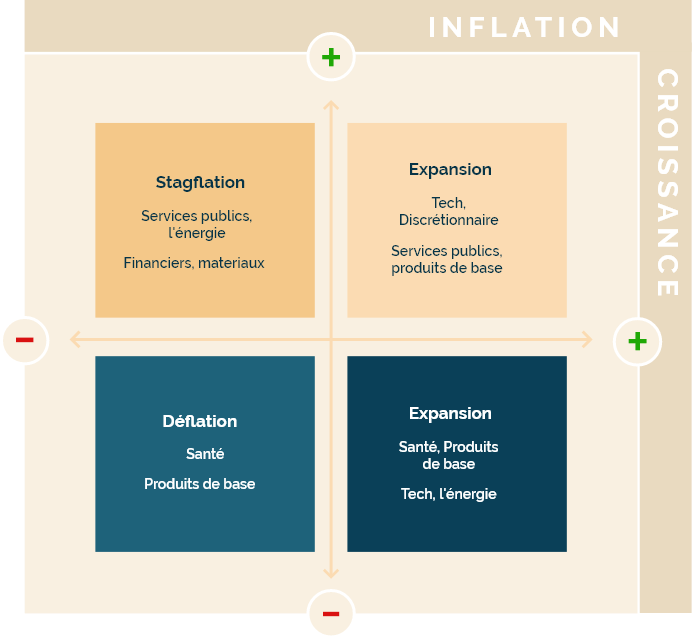

In our portfolio construction process, we conduct a comprehensive analysis of various economic parameters, including Growth, Inflation, Risk Sentiment, Microeconomic Factors, and Investment Style (e.g., Growth vs. Value or sector analysis). These factors significantly influence asset price movements and valuations in the financial markets.

The Growth/Inflation matrix was first used by investors like Harry Brown and Jay Schabacker in the 1970s. Having inspired by the matrix, we integrated it as a foundational element of our model. Additionally, we evaluate the potential returns of the diverse asset classes based on these macroeconomic scenarios, that are considered while building our model portfolios. Our asset classes are influenced by the Yale model, which broadens the investment universe by incorporating alternative underlying. The resulting model portfolios are customized to meet the specific requirements of each client.

These factors and the resulting analysis hence enable us to construct portfolios that are responsive to evolving market conditions, providing protection against significant downturns (with stable volatility) while delivering consistent and robust performance over the long.

The LS Advisors Asset Management Method

Here are the different steps we follow to build your portfolio:

Our Asset Management Vehicles

Life Insurance and Capitalization Contracts

We offer personalized management starting from 125,000 euros through a Luxembourg or Irish life insurance or capitalization contract (FID, FIC, FAS).

For Luxembourg insurance companies and custodians, you will find a list of our partners.

Securities Accounts

Since 2012, LS Advisors Mauritius has been offering its clients discretionary management through securities accounts held with our top-tier banking partners.

In terms of custodians, you will find a list of our partners.

Institutional Management

We offer our institutional partners the possibility of creating customized white label funds, managed from Mauritius, with access to a range of leading investment strategies.

Contact an LSA Asset Management Partner

Asset Management Platforms with LS Advisors