Our Solutions

Structured Products

Financial Structured Products: Everything You Need to Know

A structured product is a financial instrument issued by a bank that combines a zero-coupon bond with an option that can be indexed to one or more underlying assets.

The performance of the structured product is indexed to the performance of the underlying asset. The underlying asset usually takes the form of an index or a stock, but it can also include other asset classes such as bonds or commodities.

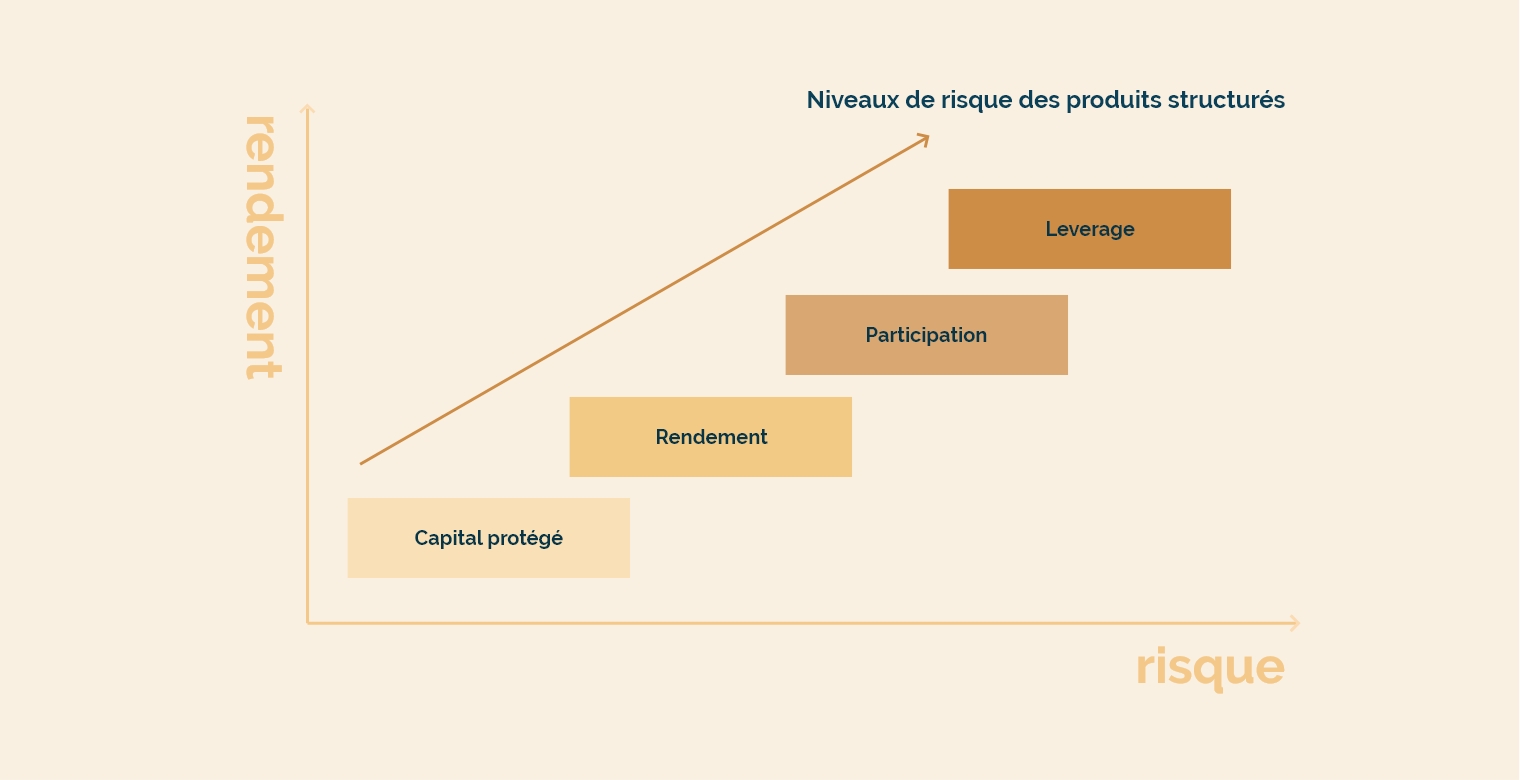

Structured products are designed to diversify beyond traditional assets like stocks or bonds. Fully adaptable to an investor's risk profile, they offer a customized solution that combines attractive potential returns with conditional capital protection.

Types of Financial Structured Products

Structured products are eligible for various types of investment vehicles and can take the form of units of account within a French or Luxembourg life insurance policy, a capitalization contract or a securities account.

The characteristics of a structured product are defined during its creation, based to the investor's specifications. The parameters to define include the underlying asset(s), the investment period, the capital protection and the potential gain.

Among the mechanisms to be defined during the product design are early redemption through a fixed or decreasing barrier, conditional or guaranteed payment of a coupon, a memory effect on the coupon, optimization of the entry point, etc.

Using structured products today gives you the opportunity to tailor your investment strategy.

Structured Products Offer at LS Advisors

We support our clients in designing these products from A to Z, from proposing investment ideas based on their needs to monitoring their products in the portfolio and on the secondary market, optimizing product parameters and securing the best possible conditions from our banking partners.

LS Advisors has established solid business relationships with most major players and issuing banks in France and internationally. This allows us to offer a range of tailored and competitive solutions to our clients, enabling them to take advantage of the diverse opportunities that can arise in the financial markets.

Lassie: The Management Platform for Your Structured Products

We offer our institutional partners the possibility to create customized white-label funds for them, managed from Mauritius, with access to a wide range of top-tier investment strategies.

Our management service, integrated with our brokerage platform, which we were the first to offer in Europe, also allows you to request quotes in the morning and have your products included in your portfolio that same evening (including life insurance contracts) at no extra cost!

Contact a Specialist in Structured Products