MAKING A SUCCESS OF YOUR RE-INVESTMENT THROUGH A CONTRIBUTION-ASSET DEAL

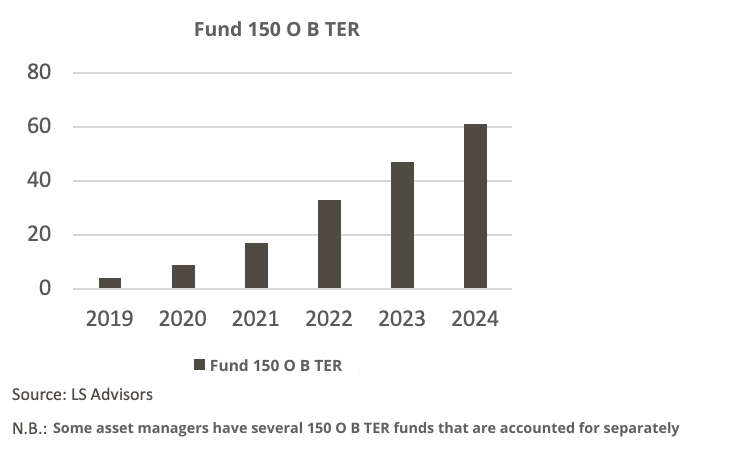

( 150 0B TER )

The transfer of shares to a new holding company created for the purpose, in order to benefit from a tax deferral on capital gains.

In this case, the gains generated by the sale of the company, which takes place at a later date, must be reinvested in order to benefit from this tax deferral (Article 150-0 B Ter of the CGI).

To do so, you need to reinvest 60% of the proceeds from the sale of your company, either directly or via funds eligible for the scheme, within two years of the sale.

A growing number of funds meet the eligibility criteria, but not all are created equal.

If you are making a long-term investment, you need to be sure that the management company that will manage your assets is reliable and long-lasting.

We've had more than 10 years of free money, but that's no longer the case with rising interest rates, so we need to be sure of the level of leverage used in the fund, and identify the factors that are expected to add performance to your investment.

SEE IF NOT MORE RECENT?

The growing number of players in the management of funds of this type has led to an increasing dispersion of returns, which in turn means a growing need for ex-ante analysis in order to make the right choice.

Diversification is a golden rule when it comes to investing, and even more so when it comes to private equity, which is a long-term investment. In addition to avoiding the risk of capital loss and default, sector and geographic diversification ensures a decorrelated portfolio. In addition, liquidity risk is often underestimated by transaction advisors (see point 5). Depending on the size of the portfolio, a minimum of 4 to 6 funds seems optimum to us, which corresponds to the classic level of diversification found in institutional fund management...

Liquidity in the prospectus

Liquidity in prospectus

Liquidity at the end of the day

The principle of private equity is that shares are not listed on an organized market. The sale of each shareholding is therefore dealt with on a case-by-case basis, which makes the sale process relatively lengthy, and the investor cannot, as on the stock market, sell his shares in a matter of seconds and immediately receive the cash from the sale.

Products are often presented on sales sheets with a holding period that does not include possible extension periods, whereas a private equity investment should be considered as being for the entire period, i.e. 12 years in the longest cases! It is therefore imperative to be accompanied by a specialist who can identify the true maximum duration of your investment.

What's more, in certain specific cases (difficulty in disposing of a major fund asset, for example, or the appointment of a liquidator in the event of manager bankruptcy or embezzlement), liquidity may be higher than that stipulated in the prospectus, in order to protect unitholders.

But there are also other important factors for which our customers often need assistance:

Your LS Advisors partner: